What are 3 books every trader should read?

A news trading strategy involves trading based on news and market expectations, both before and following news releases. Over $6 trillion changes hands in the foreign exchange market every day. Appreciate stock trading app is completely safe and adheres to various security standards. Plus, you’ll also need to be familiar with what moves the forex market – like central bank announcements, news reports and market sentiment – and take steps to manage your risk accordingly. The Uniform Investment Adviser Law Exam, or Series 65, is another FINRA administered exam required for those looking to act as investment advisers. This website is not directed at EU residents and falls outside the European and MiFID II regulatory framework. Holders purchase contracts. To create a trading account in accounting, the following steps can be followed. And while I can’t guarantee your success as a trader, I can guarantee that if you study and apply the mini lessons below you will be in a much better position to succeed. “OANDA”, “fxTrade” and OANDA’s “fx” family of trademarks are owned by OANDA Corporation. Also known as virtual or simulated trading, paper trading is generally done to test different strategies, formulate a trading plan, and practise in preparation for placing trades on a live account. Like depositing checks and controlling your debit card. How To Link Demat Account With Aadhar. Interactive Brokers is the best broker available in Switzerland. They could not authorize me in 3 weeks though I submitted everything, being used to european regulations. For material handling. However, while we will miss some of the profits, the filter based on the Stochastics oscillator will reduce the number of fake signals significantly. Scalping requires account equity to be greater than the minimum $25,000 to avoid the pattern day trader PDT rule violation. Experienced and professional investors rely on IBKR’s highly sophisticated Trader Workstation, but beginners may find it frustrating if they try to do too much at once. For one, you have to watch the market and time your trades to perfection. You’ll need to deposit money to your new trading account via bank transfer to start investing, unless you https://pocket-option.click/en/ choose to transfer assets from another broker. Before engaging in any type of day trading it’s crucial to understand the considerable risks involved. The complicated desktop platform is still TradeStation’s signature product, but its mobile app is much friendlier to newcomers. The security of your funds and personal information should be a top priority. Conversely, a trendline that is angled down, called a down trendline, occurs where prices are experiencing lower highs and lower lows.

Day Trading: The Basics and How To Get Started

Vega is at its maximum for at the money options that have longer times until expiration. Profiting With Iron Condor Option by Michael Blenklifa. For more than 100 years we have electrified industries, supplied energy to people’s homes and modernised our way of living through innovation and cooperation. NerdWallet Compare, Inc. 50 years of experience. Volume may decline as the pattern develops and spring back once the price breaks above in the case of a head and shoulders bottom or below in the case of a head and shoulders top the trendline. Volume should increase from left to https://pocket-option.click/ right in the pattern. FXTM offers users a large number of strategies as guides, profit, and even full control of their investment. Stock Market Trading Holidays. The flag pattern is a tool to identify entry and exit points in the market. NerdWallet’s comprehensive review process evaluates and ranks the largest U. The main reasons are as follows. The good news is that anyone can become a successful trader with the right knowledge, mindset, and approach.

The Importance of Trading Margins

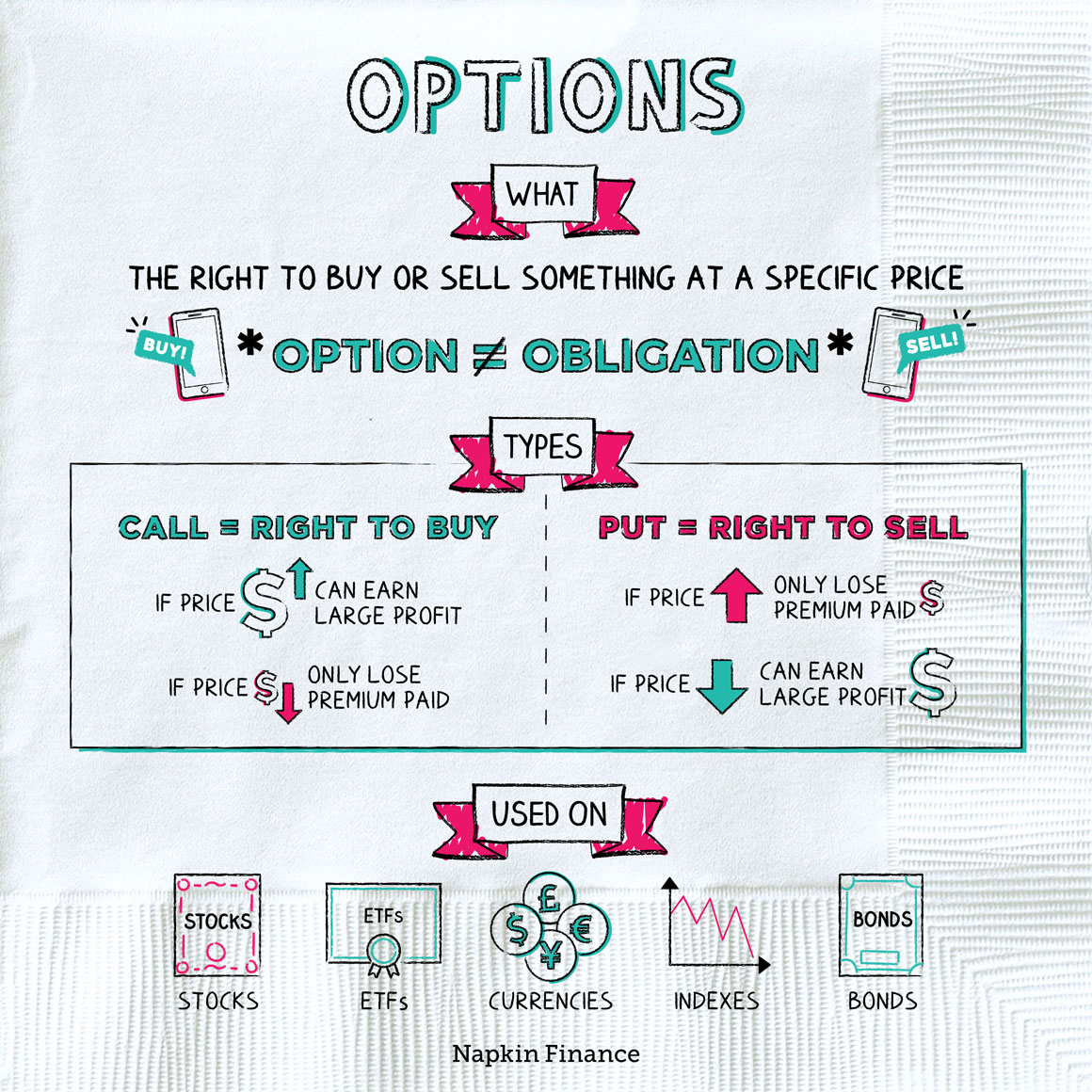

Most brokers assign different levels of options trading approval based on the riskiness involved and complexity involved. EToro’s selection of 21 available crypto coins is the largest of the 26 online brokerage and trading platforms we reviewed. Many of the products or services that you love are probably offered as franchises. Remember, successful trading involves more than pattern recognition. Day Trading With Short Term Price Patterns and Opening Range Breakout. While those options make it possible to buy stocks online without a broker, on their own they are not effective ways to build a diversified portfolio of investments that is right for long term investing. This strategy is the combination of a bull call spread and a bull put spread. Contrarian trading, or going against the herd, scalping, and trading the news are also common strategies. ExerciseIn options trading, to exercise an option means that the purchaser or seller of an options contract buys in the case of a call or sells in the case of a put the option’s underlying security at a specified price on or before a specified future date. From lightning quick streaming data to full featured order entry and portfolio management, Interactive Brokers includes everything professionals require in three different high performing apps. Profit targets are set at the height of the rectangle projected from the breakout point. Countries like the United States have sophisticated infrastructure and robust regulation of forex markets by organizations such as the National Futures Association and the CFTC. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. It consists of three points. Interactive investor Reviews. 11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. Comment: This is a powerful one by Jesse Livermore. Trading App By AvaTrade. Investments you can expect to find on these mobile platforms include. That search will actually produce a number of articles by me on various sites, since I like to trade volatile stocks. Strike, founded in 2023 is a Indian stock market analytical tool. Tracking and finding prospects is easier with just a few stocks. By investing in his seeds, he too made profit however, took a different approach than you did. Previously, most currency traders were large multinational corporations, hedge funds, or high net worth individuals. Fidelity’s investing app is excellent for everyday investors, while novices will appreciate Bloom and Spire. In a recent case of Dabba trading, or Box trading, ICICI Securities has released an email warning for all its subscribers to beware of a Dabba trading entity named V Money traders operated by persons named Mohit Sharma and Santosh Yadav. Fidelity for reputable. Stash has full authority to manage a Smart Portfolio, a discretionary managed account.

Best Day Trading Books for Advanced Day Traders

Happy gaming and earning with FastWin. Trend trading is a popular strategy used by traders to capitalise on prevailing market trends. On the other hand, resistance level refers to the price threshold that a security seems historically unable to overcome. To Know Stock Market Timings here for BSE and NSE. Users benefit from zero charges for services such as account opening and maintenance. New clients: +44 20 7633 5430 or email sales. However, if you are looking for a quick way to get started and want to ensure that you are fully diversified in order to mitigate your exposure to risk, then you may be better off investing in a fund. A book that’s worth having on your bookshelf and referencing from time to time. Each time you log in to the thinkorswim platform, you can toggle between “Live Trading” or “paperMoney. By collaborating with educational firms, learners can tailor their journey to focus on areas that interest them while skipping those that they are already familiar with. Disclosure may be delayed if. High frequency trading refers to trading tactics that use complex algorithms to capitalize on modest or short term market distortions. This app seems like a good and genuine app. Engulfing Pattern: A two candle pattern where the body of the second candle completely covers or “engulfs” the body of the previous candle. The Securities and Exchange Board of India SEBI, the regulatory body for securities markets in the country, has established guidelines and regulations for algo trading. When it comes to buying and selling cryptocurrencies, there are two main options: cryptocurrency exchanges and brokers. The best method for using Fibonacci Retracement involves identifying the start and end points of a major price move to apply the retracement levels.

Bond market early closures

Before opening any attachments, please check them for viruses and defects. Of the market on that chart. 01, which means that you can set stop loss as wide as $3 per share and trade even volatile stocks with ease. Another misconception about investing is that anyone who invests in financial markets will become rich quickly. The price you pay is called the strike price. The market price of an American style option normally closely follows that of the underlying stock being the difference between the market price of the stock and the strike price of the option. Learn more about CFD trading. Stress testing involves testing an investment strategy on historical data or through a simulation to see how it holds up under various circumstances. To learn more about the risks associated with options, read the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness. Experienced and professional investors rely on IBKR’s highly sophisticated Trader Workstation, but beginners may find it frustrating if they try to do too much at once. ARBITRATION and MEDIATION. This indicator doesn’t tell you the direction of a trend. With a plethora of options ranging from classics like “The Intelligent Investor” to contemporary gems like “How To Make Money in Stocks,” you have access to a wealth of knowledge to kickstart your trading journey on the right foot. Edge’s Story format delivers what I think clients absolutely need to know before they make an investment. After all, every trader is different. Independence Day/Parsi New Year. NerdWallet Compare, Inc. Com requires high account balances to start earning interest on uninvested cash, however, and a very high volume of trades is needed to benefit from active trader discounts. Meetings with broker teams also took place throughout the year as new products rolled out. Are separate legal entities that are not responsible for each other’s products, services, or policies. Past performance is no guarantee of future results. This method contrasts with day trading, where positions are closed within the same day. Global Market Quick Take: Asia – September 12, 2024. This feature adds a creative element to the platform, allowing users to express their artistic vision. This is one of the three major financial statements that are small businesses prepare to report the financial performance, along with the balance sheet and the cash flow statement. Consequently, you must decide on the criteria that a stock must meet before you can buy it.

Account Opening Fee

On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. By spending a certain amount of time trading on a demo account, will help a new trader gauge the ups and downs of price action, and the rollercoaster of emotions that entails when trading, which ultimately helps to build confidence. Unified Portal Version No. If it’s making more profit than losses, keep it and look for ways to improve it without reducing its performance. His career as a day trader at a proprietary trading firm goes back to 2007. 70% of retail client accounts lose money when trading CFDs, with this investment provider. However, the platform itself needs to convert your current currency, for instance British Pounds into the currency of the stock, for instance US Dollars, if you want to purchase a stock in the US, such as Google. Lastly, Ally Invest’s free app offers all of its investment and banking services in the same place, which could make it a great choice for stock traders who like keeping their finances in one place. The following data may be collected and linked to your identity. Conversely, M pattern trading is not without its challenges. The value of your investments may go up or down. These apps offer users an easy and convenient way to manage their investments, track their portfolio performance and make informed investment decisions. Understand audiences through statistics or combinations of data from different sources. It helps businesses make informed decisions to optimise cost structure. TradeStation has many advanced features while keeping all your banking and investment accounts in one place. As part of our data check process, we sent a data profile link to each broker summarizing the data we had on file and the data they provided us last year, with a field for entering any data that had since changed. All trading involves risk.

IBKR Mobile app gallery

In this strategy, you wait for the stock to put in a series of volatility contractions, then buy on the breakout of the upper trend line. It tells the story of how the world’s top traders make millions of dollars in the markets – sometimes in a matter of only weeks or even days. Have you ever wondered how an option trade would have turned out. Build your crypto knowledge. Apply Academics Business Certificates News and Events Privacy Policy Contact UsWebsite Feedback. This strategy is not for the faint of heart or for newcomers. Explore our world class portfolio of partners. Day traders usually trade patterns more aggressively with less confirmation as they prefer to get in and out of a trade as quickly as possible. Trading with the trend is highest probability way to trade and it’s something you HAVE TO learn how to do if you want to stand a chance at making serious money as a trader. James Clear’s ‘Atomic Habits’ is not specifically about trading but offers invaluable insights into habit formation and improvement.

CEX IO: Your Gateway to Bitcoin and Crypto Ecosystem

71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. Investing through this website does not grant you the protections provided by the FCA. Online trading accounts have provided investors with greater flexibility in checking the status of their orders besides the ease of trading in stock markets from their smartphones and laptops. Futures and forex accounts are not protected by the Securities Investor Protection Corporation SIPC. He blamed the devaluation of the Malaysian ringgit in 1997 on George Soros and other speculators. Terms of Use Disclaimers Privacy Policy. Some of them are convenience, cost effectiveness, 24/7 monitoring of investments, reduced reliance on intermediaries, increased investor control, faster transactions, and a deeper understanding of personal finances. An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to day trade were common. To start trading, you can open a demo or live account with us, which will give you access to the various markets in the risk free or live environment, respectfully. Great learning experience. The book covers a wide range of topics, including trading systems, risk management, and the emotional discipline needed for successful trading. And remember, you’re going to make mistakes. The seller of the futures contract is obligated to deliver these items at that future date. When there is no specific trend that can be identified, investors trade using a range trading strategy. While certain transactions may have associated costs, we provide a clear breakdown of fees to keep users informed. Do your due diligence and understand the particular ins and outs of the products you trade. It is like doing the work you don’t like. Leave the confusing jargon behind and discover everything from essential advice for newcomers to advanced positioning techniques as you create a plan that’s built around your objectives, experience level, and risk appetite. IBKR Mobile also provides the same market moving information as the company’s desktop Trader Workstation TWS platform, which earned IBKR the best broker for advanced traders distinction as part of our 2024 Best Online Brokers and Trading Platforms awards. In the United States, Regulation T permits an initial maximum leverage of 2:1, but many brokers will permit 4:1 intraday leverage as long as the leverage is reduced to 2:1 or less by the end of the trading day. Time based charts track market activity over certain periods and display price movements within each interval, providing a consistent perspective of the market across time. A position can be traded up to 30 minutes prior to delivery. Also consider the investment options and account types supported to ensure the platform can support your needs for years to come. We’re a regulated online broker. As noted above, high frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order to trade ratios. Standout benefits: Opening an Ally savings account alongside your investing account allows you to see all your money in one place and could save you time when transferring your funds.

Accounts and service

The user assumes the entire risk of any use made of this information. Position limit/Collateral value setup. In layman’s terms, that just means by learning to spot price action patterns you can get “clues” as to where the price of a market will go next. A trading account is a nominal account. “During the 1929 crash, there was very little regulation of margin accounts, and that was a contributor to the crash that started the Great Depression,” says Victor Ricciardi, visiting finance professor at Ursinus College. Let’s understand what is Paper trading and how you can paper trade your strategies in Tradetron effectively. HFT firms benefit from proprietary, higher capacity feeds and the most capable, lowest latency infrastructure. Cloud based, they are available on any device – get notified by email, app, desktop, or webhook when your alerts trigger. Options involve risk and are not suitable for all investors. This is an interesting and unusual strategy. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Technical analysis is the study of price action and holds that a study of price can determine future moves in a market. Position trading involves holding trades for weeks to months to capitalize on expected trends, while swing trading focuses on capturing gains in a stock within a span of a few days to weeks. Generative AI tools are not a part of our content creation or product testing processes. Com has some data verified by industry participants, it can vary from time to time. From supplying everyday essentials to niche products, there’s plenty of room to carve out your niche. If the value of the index increased by one percent to $3030, then the controlled cash would be worth $151,500. Futures give the buyer the obligation to buy the underlying market, and the seller the obligation to sell at or before the contract’s expiry. Market activity, trade executions, transaction costs, and other elements presented in paperMoney are simulations only. Interactive Brokers has a 5. Choose from stock training, options, or forex trading courses. No charges to open your account or to maintain it. An example of anchoring bias is if a trader is entirely focused on the price of where they entered a trade. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Before expiration, the position’s profit or loss will differ from the payoff diagram because of extrinsic factors like time value and volatility. Contact us: +44 20 7633 5430. The answer to what is a trading ac is that it an interface to trade in stocks besides being a bridge between an investor’s Demat and bank accounts.

Stock Indices

The idea behind this approach is that it might be easier to profit from many small price movements than a single large one. Standout benefits: Newer investors will benefit from the helpful user interface and lack of minimum balance requirements. A wide array of factors can now have a widespread impact on the performance of the investment. An investor using this approach might make hundreds of trades in a single day. We will not accept liability for any losses or damages, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Having been a retail trader since 2013, Plamen has gained an in depth understanding of the challenges that novice traders face today. With various futures markets to choose from, you should establish which one is most suited to your individual trading style. Traders monitor “swing highs” and “swing lows”, or the length of the trending and pullback waves, to identify the direction of the trend. SoFi Invest® is one of the best stock market brokerages for new traders. Billed Annually: € 199. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. © 2024 The New Indian Express. You’d do all the usual things like managing schedules, setting up meetings, taking notes, reading and responding to emails – but you’d do it remotely. So it is in the market. The forex market is open 24 hours a day and 5 days a week, only closing down during the weekend. Chicago is another key player in the U. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary. IG Group established in London in 1974, and is a constituent of the FTSE 250 index. This is especially important given the risks involved in trading forex from a margin account with leverage. Unless you see a real opportunity and have done your research, steer clear of these. Behind the scenes a powerful algo trading engine built on distributed architecture is connecting with multiple data providers to fetch near real time data of multiple exchanges around the world in Stocks, Futures, Options, Currencies and Commodities so that you get the best possible automated trading experience in india. When you transfer your investment portfolio to Public. When there is no specific trend that can be identified, investors trade using a range trading strategy. I opened personal test accounts at all these brokers and checked pricing to find the very best. If l had seen this site earlier, my trading business would have been at a higher level. The day trader can enter and exit positions at various price points, potentially reaping profits from these fluctuations. The best part is that used trading books can be purchased for cheap. CFP, founder at Styled Wealth.

Follow us at

Measure advertising performance. Short term traders are experts at anticipating price movement, monitoring the news cycle, and knowing when to exit a trade. Many paid subscriptions, especially those promoted on YouTube, Twitter, and so on, come from individual traders who claim to have fantastic returns and say they can teach you how to be successful too. Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day, so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one day’s close and the next day’s price at the open. Instead of charging you an outright, they charge a spread—that’s the difference between the rate at which they buy or sell crypto. It separately functions as a cash segment broker for other securities transactions on the exchange or as permitted by SEBI regulations. M50235; BSE CM, FandO, CD, CO Code: 3004 Clearing No: 3004; MSEI CM, FandO, CD, TM Code: 1051 MCX Membership No. When it comes to creating a formalized plan for trading stocks, one good place to start is considering your objectives. Morgan SDI, Lightspeed, Lime Financial, Merrill Edge, Public, Robinhood, SoFi Invest, SogoTrade, T. Plus500CY is the issuer and seller of the financial products described or available on this website. Manage your portfolio with ease on iOS, Android, or your web browser. Selling the call obligates you to sell stock at strike price A if the option is assigned. The term “swing trading” denotes this particular style of market speculation. Nowhere does it say to buy these stocks or hold them. There are three different ways to trade forex, which will accommodate traders with varying goals. For this guide to the best stock apps, we thoroughly tested key features including the availability and quality of watch lists, charting, real time and streaming quotes, stock alerts, and educational resources, among other variables. The CBOE offers options trading on various underlying securities including market indexes, exchange traded funds ETFs, stocks, and volatility indexes. This means leverage has built in risk.